One-Year | Three-Year | | Five-Year | | Ten-Year | | | • | After thorough consideration, the Board determined that shareowners are best served if the roles of Chairman and CEO are combined in current CEO Adamczyk (seepage 13). | | | | | | | • | The Board believes that Mr. Adamczyk has the character and quality of leadership to serve in both roles and that his service as both Chairman and CEO will enhance company performance. |

Changes to Our Corporate Governance Guidelines to Improve Board Refreshment

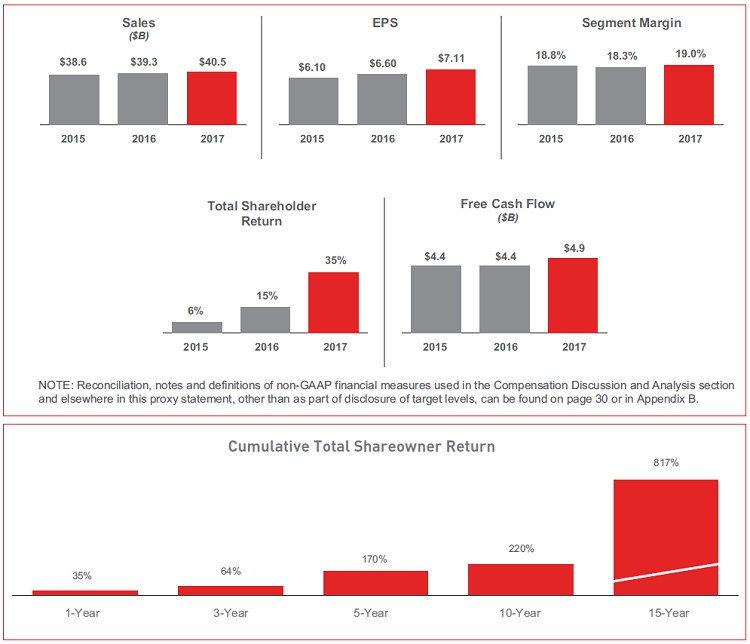

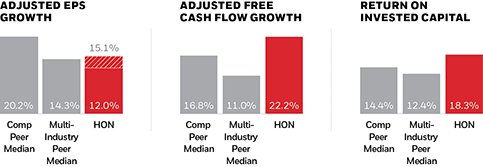

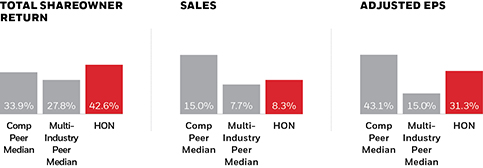

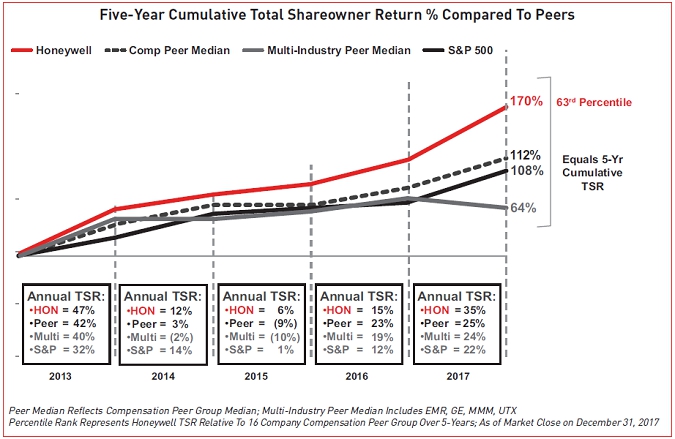

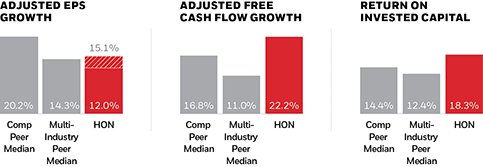

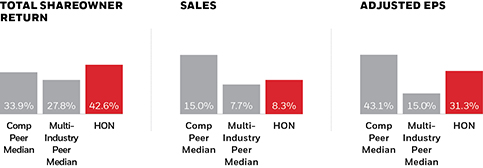

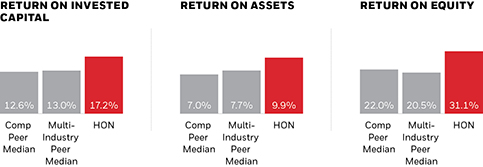

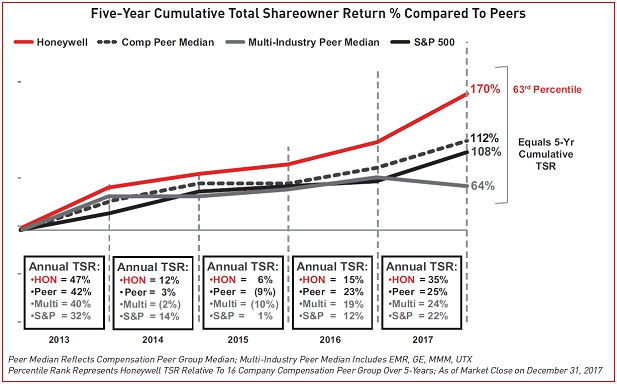

| | • | Multi-Industry Peers = 100th Percentile | Before recommending re-nomination of incumbent directors, our Corporate Governance and Responsibility Committee (“CGRC”) will now evaluate whether the skills and perspectives of incumbent directors meet Honeywell’s needs, both individually and collectively. | Multi-Industry Peers = 100th Percentile | | Multi-Industry Peers = 100th Percentile | | Multi-Industry Peers = 100th Percentile | | | | | | Compensation Peers = 82nd Percentile | | Compensation Peers = 64th Percentile | | Compensation Peers = 67th Percentile | | Compensation Peers = 88th Percentile |

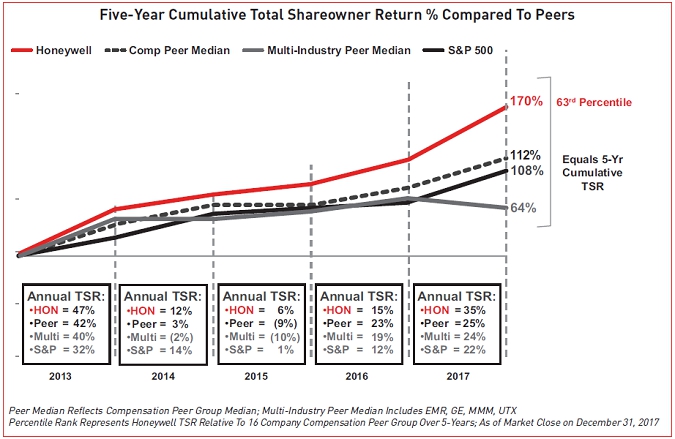

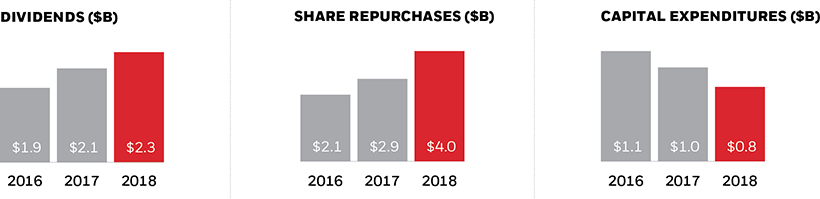

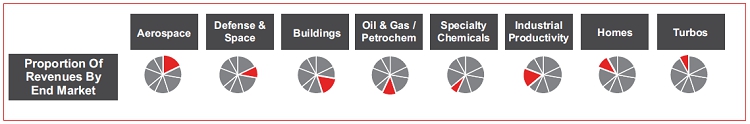

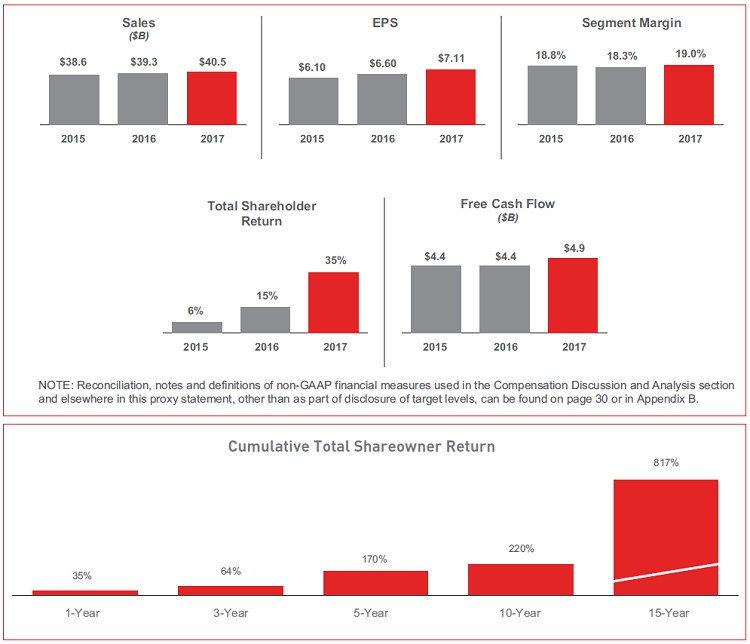

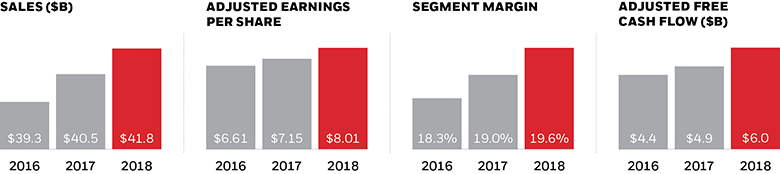

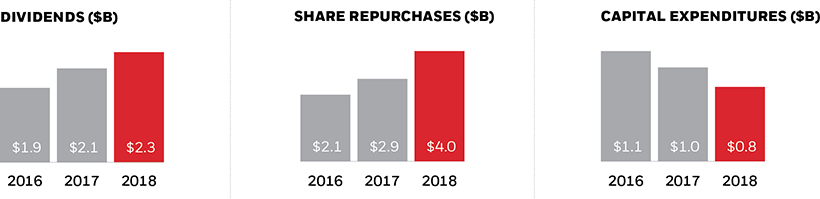

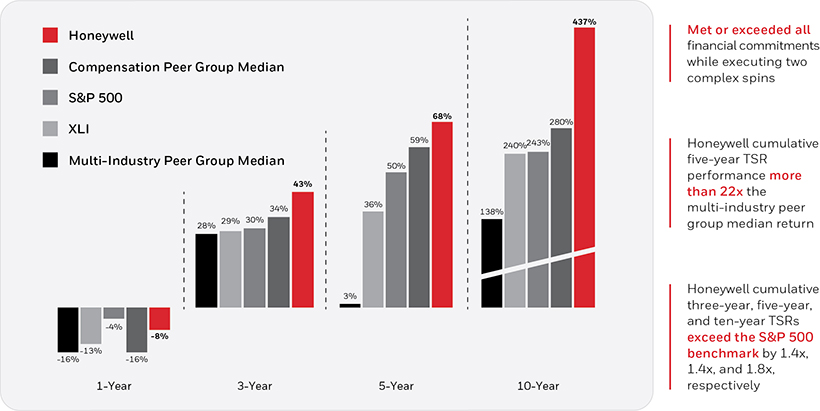

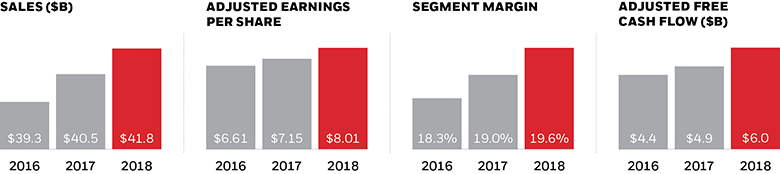

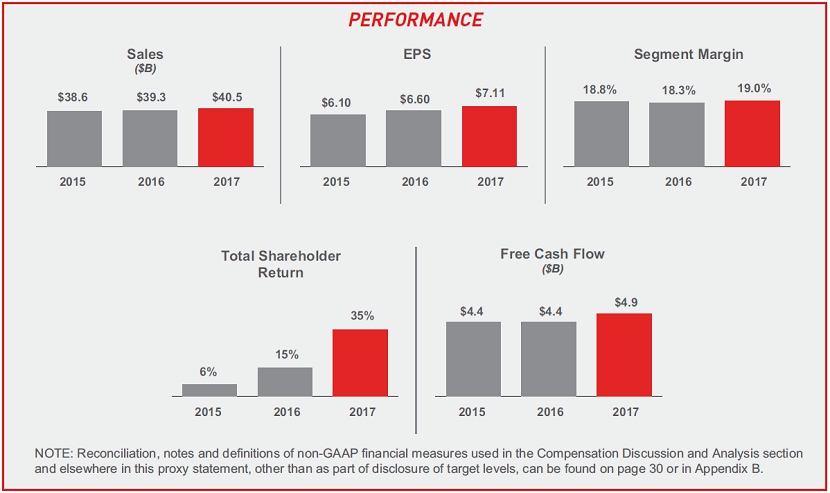

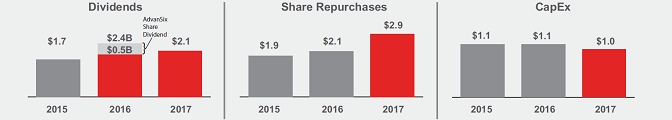

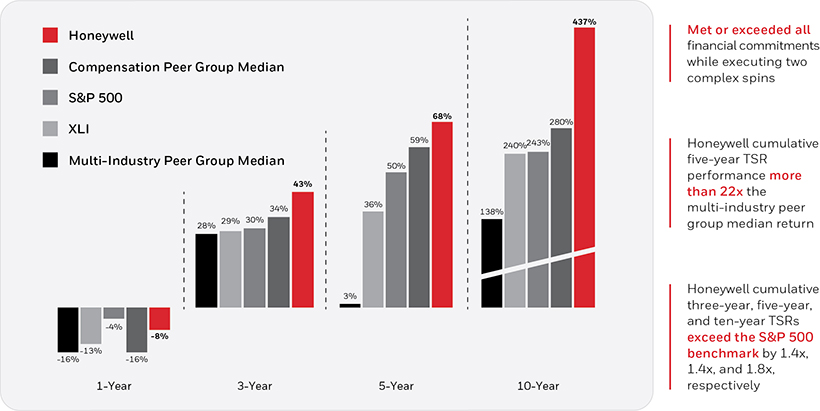

Source: S&P Capital IQ TSR is calculated by the growth in capital from purchasing a share in the company and assuming the dividends and share distributions received from any spins are reinvested in the applicable company at the time they are paid. In 2018, we continued to stay the course and executed on our commitments to shareowners. We made substantial progress in advancing our strategic initiatives, transformed the Honeywell portfolio through two spins, gave back to the community, and upgraded the working experience for our employees. While our work in the community, for our customers, for our employees, and for our shareowners is not over, we are proud of the outstanding achievements we accomplished throughout the year. | | | | |

| | | Notice and Proxy Statement | 2019 | | 3 |

OUR 2019 DIRECTOR NOMINEES

| | | | | | | | | | | | | | | | | | | | | | | Nominee | | Title | | Years of

Service | | Independent | | No. of Current Public

Company Boards

(including Honeywell) | | Committee

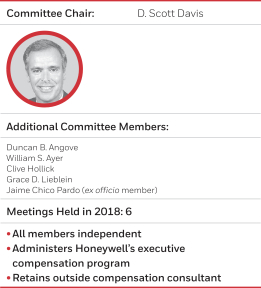

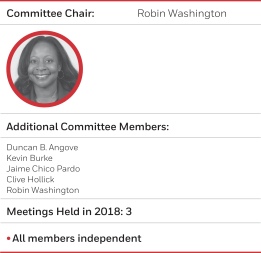

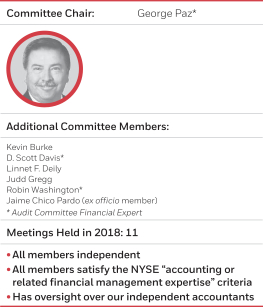

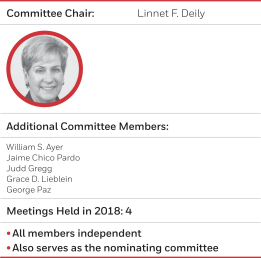

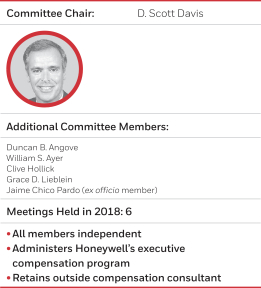

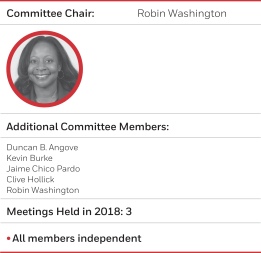

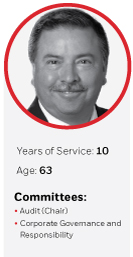

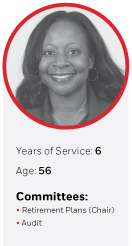

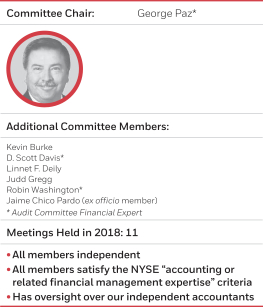

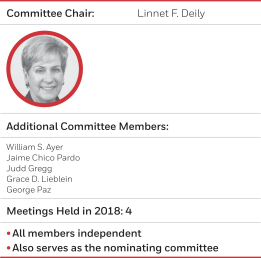

Memberships | | | | | | | | | | | | | | | | | | | Darius Adamczyk (Chairman and CEO) | | Chairman and Chief Executive Officer Honeywell International Inc. | | 2 | | No | | 1 | | — | | | | | | | Jaime Chico Pardo (Lead Director) | | President and Chief Executive Officer ENESA, S.A. de C.V. | | 19 | | Yes | | 3 | | CGRC Retirement Plans Ex officio: Audit, MDCC | | | | | | | Duncan B. Angove | | Chief Executive Officer and Managing Partner Warmaug Partners LLC | | 1 | | Yes | | 1 | | MDCC Retirement Plans | | | | | | | William S. Ayer | | Retired Chairman and Chief Executive Officer Alaska Air Group, Inc. | | 4 | | Yes | | 1 | | CGRC MDCC | | | | | | | Kevin Burke | | Retired Chairman, President and Chief Executive Officer Consolidated Edison, Inc. | | 9 | | Yes | | 1 | | Audit Retirement Plans | | | | | | | D. Scott Davis | | Retired Chairman and Chief Executive Officer United Parcel Service, Inc. | | 13 | | Yes | | 2 | | MDCC (Chair) Audit | | | | | | | Linnet F. Deily | | Former Deputy United States Trade Representative and Ambassador | | 13 | | Yes | | 1 | | CGRC (Chair) Audit | | | | | | | Judd Gregg | | Former Governor and U.S. Senator of New Hampshire | | 8 | | Yes | | 2 | | Audit CGRC | | | | | | | Clive Hollick | | Former Chief Executive Officer United Business Media | | 15 | | Yes | | 1 | | MDCC Retirement Plans | | | | | | | Grace D. Lieblein | | Former Vice President-Global Quality General Motors Corporation | | 6 | | Yes | | 3 | | CGRC MDCC | | | | | | | George Paz | | Retired Chairman and Chief Executive Officer Express Scripts Holding Company | | 10 | | Yes | | 2 | | Audit (Chair) CGRC | | | | | | | Robin L. Washington | | Executive Vice President and Chief Financial Officer Gilead Sciences, Inc. | | 6 | | Yes | | 2 | | Retirement Plans (Chair) Audit |

CGRC refers to Corporate Governance and Responsibility Committee, and MDCC refers to Management Development and Compensation Committee. | | | | | | | | | 4 | |

| | | | Notice and Proxy Statement | 2019 | | | |

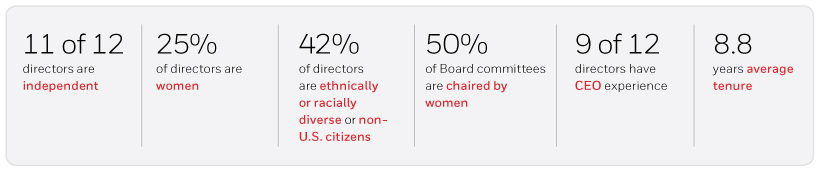

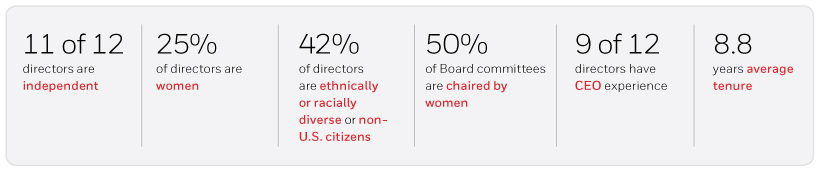

CORPORATE GOVERNANCE HIGHLIGHTS | | | | | SHAREOWNER EMPOWERMENT AND ENGAGEMENT | |

| | 15% threshold for shareowners to call a special meeting | | | • | The | Majority vote to amend Certificate of Incorporation and By-laws | |  | | Annual election of all directors, with majority voting in uncontested director elections | |  | | No poison pill – we will seek shareowner approval if a shareowner rights plan is adopted | |  | | Robust year-round shareowner engagement, with Lead Director participation in shareowner discussions | |  | | Proxy access enabling shareowner(s) holding 3% of our stock for three years to include up to two director nominees (or nominees representing 20% of the Board) in our proxy | DIVERSE AND INDEPENDENT BOARD OF DIRECTORS | |

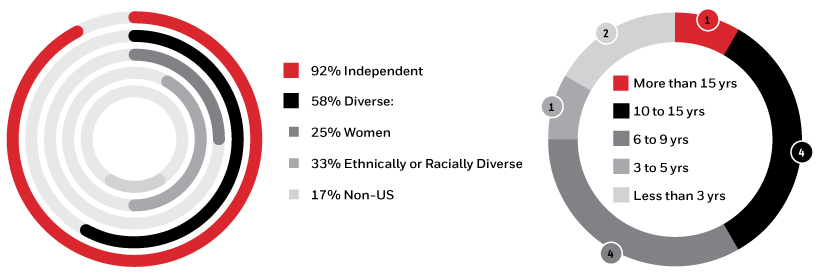

| | All director nominees are independent, except our CEO; no nominees with disclosable related-party transactions | |  | | Leader in Board is applying greater rigor around thediversity vis-à-vis personal characteristics (3 women, 3 Hispanics, 1 African-American, 2 non-U.S. citizens) and experiences (industry, profession, public service, geography) | |  | | Range of tenures to facilitate effective oversight and balance between historical experience and fresh perspectives | |  | | Skills and background aligned to our strategic direction | |  | | Clear, transparent director recruitment and selection process that formally prioritizes skills and qualifications and emphasizes leadership traits, work ethic, independence, business experience, and diversity of background | |  | | No director may serve on more than four public company boards (including the Honeywell Board) | BEST-IN-CLASS BOARD STRUCTURE AND PROCESSES | |

| | Independent Lead Director elected by independent directors, with expanded duties and responsibilities, including formal responsibility for working with the Corporate Governance and Responsibility Committee (CGRC) to lead new director selection and joint leadership of annual Board self-evaluation process | |  | | Regular executive sessions of independent directors | |  | | All members including a formal process for identificationof all committees are independent directors | |  | | Lead Director and prioritization of skill sets by the Chair of the CGRC Chairman/CEO, and Lead Director.empowered to call special Board meetings at any time for any reason | | |  | |

|  | Duncan B. Angove was recruitedAnnual self-assessment to the Honeywellenable adequate Board refreshment and appropriate evolution of Board skills, experience and perspectives; results shared and discussed in early 2018 and demonstrates the Board’s commitment to refreshment withexecutive session of independent nominees possessing the perspective and experience to help propel the Company’s long-term strategy of becoming a world-leading software-industrial company. Mr. Angove has over 19 years of experience developing and commercializing software products and services for numerous industry verticals. Since 2010, Mr. Angove has served as a President of Infor, Inc., a provider of software solutions and platforms, as well as individual apps, that develops end-to-end operational systems and specific business processes for numerous industry verticals from chemicals to retail. |

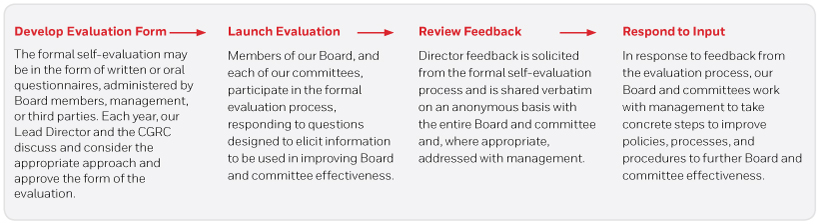

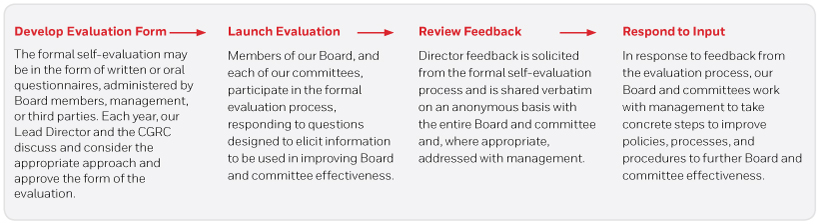

Improvements to the Board’s Self-Evaluation Process

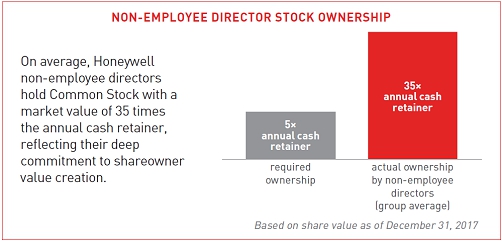

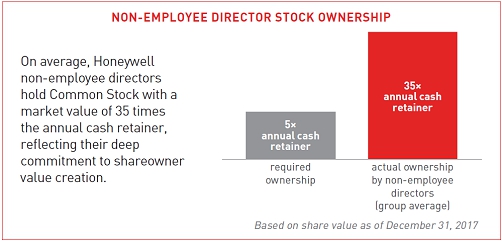

| • | We are using the self-evaluation process in a more structured way to elicit specific feedback on whether and how the Board needs to refresh its membership to better serve the long-term needs of shareowners, particularly in light of Honeywell’s evolving strategy.directors | | |  | | Annual refresh of Corporate Governance Guidelines to ensure alignment with best practices | | | • | We are reinforcing best practices to ensure that the self-evaluation process is meaningful, including sharing results | Director stock ownership guidelines require equity holdings of director surveys and questionnaires verbatim on an anonymous basis with the entire Board and discussing the resultsat least 5x annual cash retainer (actual ownership average of the annual self-evaluation with the full Board in executive session. |

Strengthening of the Role of Lead Director

Honeywell’s Corporate Governance Guidelines were amended to add two new duties to the Lead Director’s role, specifically, making the Lead Director formally responsible for new director recruitment and selection and jointly responsible for leading the self-evaluation process (together with the Chair of the CGRC).

Ongoing Robust Dialogue Between Our Directors and Shareowners29x as of December 31, 2018)

ROBUST OVERSIGHT OF RISKS AND OPPORTUNITIES | | • | In 2017 we continued our strong tradition of meaningful engagement between our directors and largest shareowners. Our Lead Director and the Chair of the CGRC met with 11 of our shareowners in 2017 to discuss a range of pertinent governance matters, including the decision on whether to combine the roles of Chairman and CEO (seepage 4). The content of these meetings is shared with the entire Board and provides an extremely valuable perspective to the Board in its decision-making. |

Other Changes You Will See In This Proxy Statement

| • | The Board has created a formal skills and experience matrixresponsible for risk oversight, with specific responsibility for key risk areas delegated to help ensure that it has the right perspective to appropriately exercise its independent oversight responsibilities (seepage iv).relevant Board committees | | |  | | Robust Enterprise Risk Management (ERM) program to enable Board identification and monitoring of key risks | | | • | We increased the mandatory retirement age for directors from 72 to 75 to ensure Board continuity during a successful CEO succession process that was architected and “owned” by the current Board and during a period in which we are executing two complex spin-off transactions that resulted from a comprehensive portfolio review process overseen by the current Board. |

2018 | Proxy and Notice of Annual Meeting of Shareowners |   | | iii | Purposeful inclusion of key risk areas on Board and/or committee agendas, enabling continuous Board oversight of risk mitigation |

| |  | | Annual engagement with business leaders to discuss both short-term plans, long-term strategic opportunities and their associated risks |

| Table | | Incentive compensation not overly leveraged and with maximum payout caps and design features intended to balance pay for performance with the appropriate level of Contentsrisk-taking |

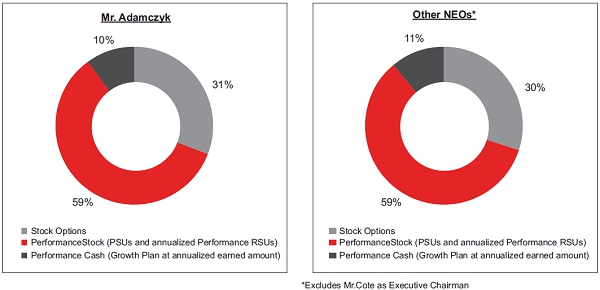

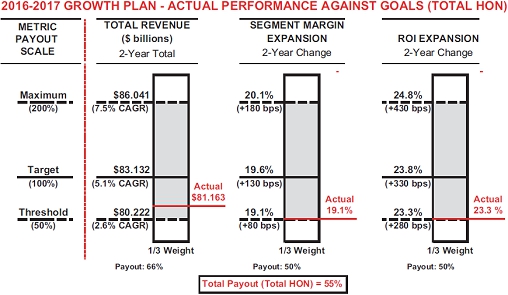

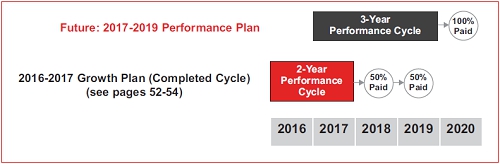

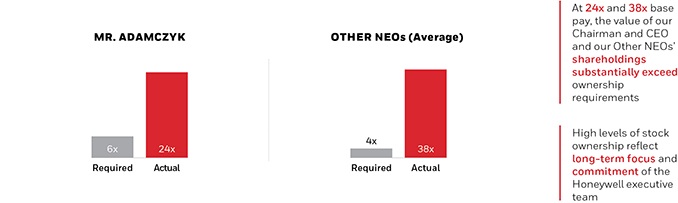

Proxy Summary> Executive Compensation Snapshot

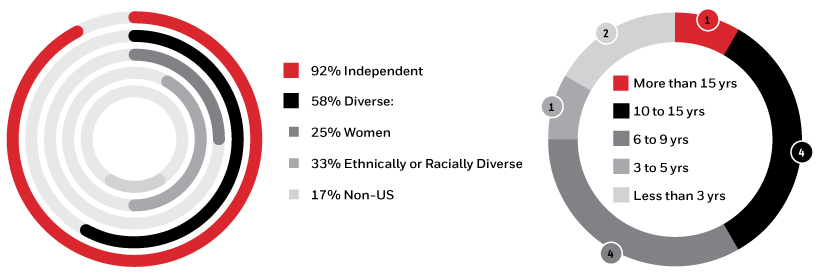

Independent and Highly Diverse Oversight*a significant restatement or violations of non-competition or non-solicitation agreements

| Of the Independent Directors:

•27%are WomenCOMMITMENT TO

SUSTAINABILITY AND CORPORATE RESPONSIBILITY | | •27%are Hispanic

| | • 9%Code of Business Conduct applies to all directors, officers, and employees

| |  | | Suppliers expected to comply with published Supplier Code of Conduct, including conflict minerals, anti-human trafficking, business integrity, and health, safety, and environmental policies | |  | | Uncompromising adherence to foundational principles of Integrity and Ethics, Supporting Diversity, and Workplace Respect, while fostering a performance culture based on our 8 Behaviors | |  | | Over 50% of executive officers are African Americandiverse by ethnic background, place of birth (non-U.S.) or gender | |  | | No use of corporate funds for political contributions and careful oversight and transparency with respect to political lobbying activities | |  | | Demonstrated track record of exceeding our published greenhouse gas reduction and energy efficiency goals | |  | | Health, Safety, Environment, Product Stewardship, and Sustainability management operating system, with quarterly CEO reviews and regular Board oversight drive our establishment and achievement of sustainability goals | |  | | Honeywell Hometown Solutions, our corporate citizenship initiative, delivers high-impact social sustainability programming around the world •18%are Non-U.S. Citizens

|

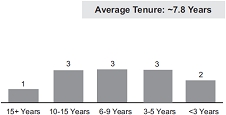

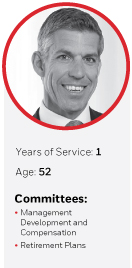

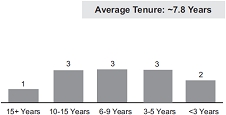

Right Balance of Institutional Knowledge

| | | | |

| | | Notice and Proxy Statement | 2019 | | 5 |

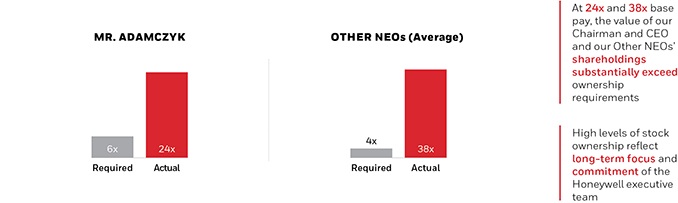

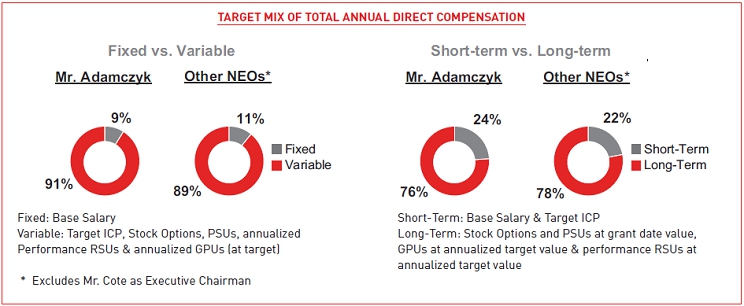

and Fresh Perspective*

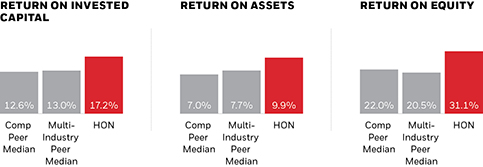

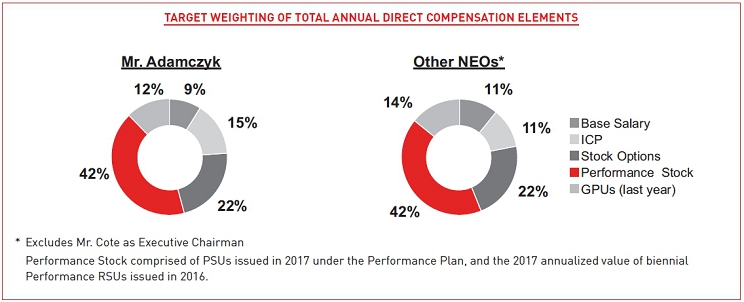

EXECUTIVE COMPENSATION SNAPSHOT | | | | | | | I WHAT WE DO | | I WHAT WE DON’T DO |  | | Pay for Performance.We closely align pay and performance, as a significant portion of target total direct compensation is at-risk. The Management Development and Compensation Committee (MDCC) validates this alignment annually and ensures performance-based compensation comprises a significant portion of executive compensation. | |  | | No Excessive Perks.We do not provide perquisites except in cases where there is a compelling business or security reason, nor do we provide gross-ups, except in limited cases for relocation. |  | | Robust Performance Goals.We establish clear and measurable goals and targets and hold our executives accountable for achieving specified targets to earn a payout under our incentive plans. Performance goals are linked to operating priorities designed to create long-term shareowner value. | |  | | No Guaranteed Annual Salary Increases or Bonuses.Annual salary increases are based on evaluations of individual performance and the competitive market. In addition, we do not provide guarantees on bonus payouts. |  | | Double Trigger in the Event of a Change-in-Control (CIC). We have double trigger vesting on equity and severance for CIC; executives will not receive cash severance nor will equity vest in the event of a CIC unless accompanied by qualifying termination of employment. | |  | | No New Excise Tax Gross-Ups and No Accelerated Bonus Payments Upon CIC.We eliminated gross-ups for excise taxes upon a CIC for any new officers since 2009. Plans provide that ICP awards earned in the year of a CIC would be paid at the time they would typically be paid based on business performance rather than target. |  | | Maximum Payout Caps for Incentive Plans.Annual cash incentive compensation plan (ICP) and performance plan payouts are capped. | |  | | No Incentivizing of Short-Term Results to the Detriment of Long-Term Goals and Results. Pay mix is heavily weighted towards long-term incentives aligned with the interests of shareowners. |  | | Clawback Practice.We maintain a policy that allows for recoupment of incentive compensation for any significant financial restatement or if an executive leaves the Company to join a competitor. | |  | | No Excessive Risks.Compensation practices are appropriately structured and avoid incentivizing employees to engage in excessive risk-taking. |  | | Robust Stock Ownership Requirements.We require executives to hold meaningful amounts of stock and require them to hold 100% of net shares for one year from exercise or vesting. | |  | | No Hedging or Pledging. We do not allow hedging or pledging of our stock. |  | | Independent Compensation Consultant.We retain an independent compensation consultant on behalf of the MDCC to review and advise the MDCC on executive compensation matters. The independent consultant attends all MDCC meetings. | |  | | No Consultant Conflicts.Under the MDCC’s established policy, the compensation consultant cannot provide any other services to Honeywell without the MDCC’s approval. Regular independence reviews are conducted. |

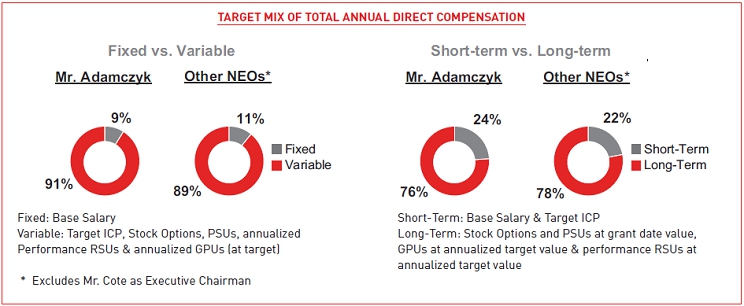

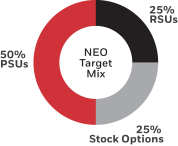

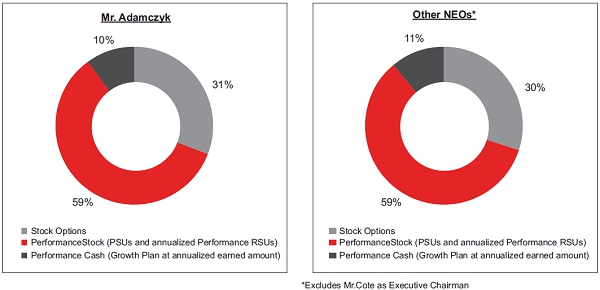

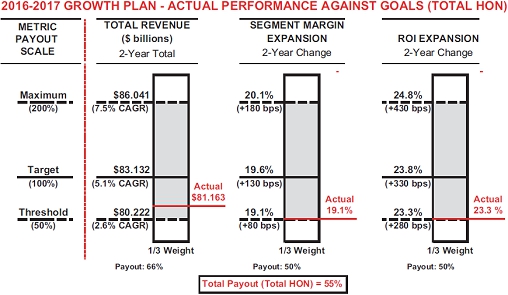

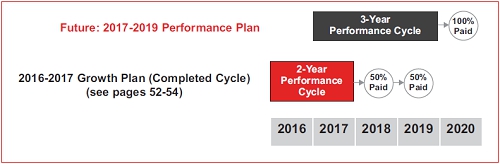

2017 Total Annual Direct Compensation For Each Named Executive Officer (NEO)I 2018 EXECUTIVE COMPENSATION

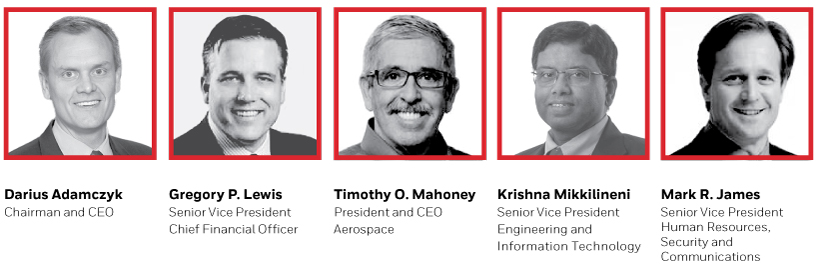

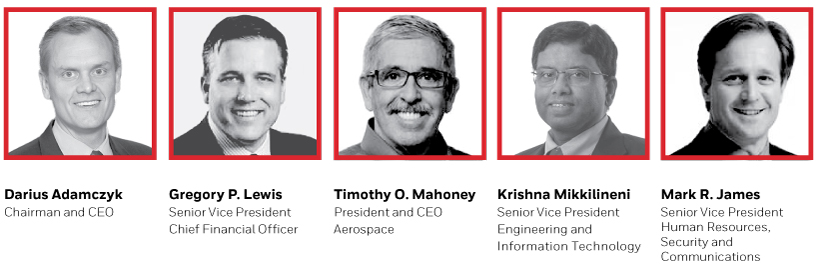

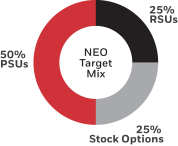

The following table reflects 2017 annualized2018 compensation amounts earned by the NEOsawarded or paid to our Named Executive Officers (NEOs) from the perspective of the MDCC*. | NEO | | Position | | Base

Salary | | | Annual

Bonus | | | Stock

Options | | | 2017-2019

Performance

Plan-PSUs(A) | | 2016 Biennial-

Performance

RSUs(B) | | 2016-2017

Growth Plan(C) | | Total Annual

Direct

Compensation | | Darius Adamczyk | | President & CEO | | $1,414,615 | | | $3,275,000 | | | $3,596,400 | | | $5,254,000 | | | $1,671,875 | | | $1,224,000 | | | $16,435,890 | | | Thomas A. Szlosek | | SVP - Chief Financial Officer | | $865,039 | | | $1,100,000 | | | $1,798,200 | | | $2,101,600 | | | $1,337,500 | | | $687,500 | | | $7,889,839 | | | Timothy O. Mahoney | | Aerospace - President & CEO | | $963,615 | | | $1,540,000 | | | $2,064,600 | | | $2,232,950 | | | $2,006,250 | | | $450,000 | | | $9,257,415 | | | Krishna Mikkilineni | | SVP- Engineering, Ops and IT | | $785,769 | | | $915,000 | | | $1,798,200 | | | $1,970,250 | | | $1,471,250 | | | $550,000 | | | $7,490,469 | | | Rajeev Gautam | | PMT - President & CEO | | $717,885 | | | $1,040,000 | | | $1,165,500 | | | $1,576,200 | | | $668,750 | | | $772,500 | | | $5,940,835 | | | David M. Cote(D) | | Executive Chairman & Former CEO | | $900,962 | | | $3,420,000 | | | $9,990,000 | | | $0 | | | $0 | | | $2,612,500 | | | $16,923,462 | |

* | Table reflects the view of the MDCC by annualizing 2016 biennial awards over a 2-year period (half of the award was attributed to 2016 and half to 2017), which differs from how amounts are reported on the SEC Summary Compensation Table. This is the last year reporting on this basis with normalizaton in 2018 as part of the changes to the executive compensation program. | (A) | Grant date value of the first annual award of 3-year Performance Stock Units (PSUs). | (B) | Reflects 2017 portion of the 2016 biennial Performance-based RSU grant with 100% of payout tied to Honeywell’s relative TSR performance against Compensation Peer Group over 3-years, followed by longer-term vesting period. Last such biennial RSU grant prior to compensation program changes. | (C) | Annualized amount earned from the 2016 biennial Growth Plan grant for the 2016-2017 performance cycle. Portion attributable to 2017. Plan discontinued after this payout. | (D) | Mr. Cote not included in broader compensation program changes for last full year of employment as Executive Chairman. The 2017 stock option grant to Mr. Cote, was made while in the CEO role and represented his last LTl grant from Honeywell. No other LTl was granted to Mr. Cote in 2017. Mr. Cote will receive no other compensation for the five-year consulting services arrangement included in his June 2016 CEO Continuity Agreement, which will begin when he leaves the Board in April of 2018. Earned Growth Plan award to be settled in stock, pursuant to 2016 MDCC decision to reduce value of his compensation paid in cash in response to shareowner feedback. |

MDCC. See Compensation Discussion and Analysis beginning onpage 3138 for more details on 2017 Executive Compensation.2018 executive compensation. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | NEO | | Position | | Base

Salary | | | Annual

Incentive

Plan (ICP)(1) | | | 2018-2020

Performance

Plan Units(2) | | | Stock

Options(3) | | | Restricted

Stock Units(4) | | | Total Annual

Direct

Compensation | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Darius Adamczyk | | Chairman and CEO | | $ | 1,571,154 | | | $ | 4,100,000 | | | $ | 6,375,720 | | | $ | 3,185,655 | | | $ | 3,185,495 | | | $ | 18,418,024 | | Gregory P. Lewis | | SVP and Chief Financial Officer | | $ | 578,981 | | | $ | 730,000 | | | $ | 525,000 | | | $ | 591,250 | | | $ | 554,742 | | | $ | 2,979,973 | | Timothy O. Mahoney | | President and CEO, Aerospace | | $ | 992,788 | | | $ | 1,840,000 | | | $ | 3,057,076 | | | $ | 1,523,060 | | | $ | 1,522,822 | | | $ | 8,935,746 | | Krishna Mikkilineni | | SVP, Engineering and IT | | $ | 810,673 | | | $ | 930,000 | | | $ | 2,632,028 | | | $ | 1,307,845 | | | $ | 1,305,276 | | | $ | 6,985,822 | | Mark R. James | | SVP, HR, Security and Communications | | $ | 774,231 | | | $ | 1,080,000 | | | $ | 2,354,112 | | | $ | 1,173,040 | | | $ | 1,165,425 | | | $ | 6,546,808 | | Thomas A. Szlosek(5) | | Retired Chief Financial Officer | | $ | 560,481 | | | $ | — | | | $ | 2,713,768 | | | $ | 1,348,050 | | | $ | 1,336,354 | | | $ | 5,958,653 | |

iv |  | Proxy and Notice of Annual Meeting of Shareowners | 2018ICP payouts determined 80% based on a calculation against pre-set goals. The remaining 20% was based on individual assessments. |

| (2) | Grant date value of performance stock units (PSUs) issued for a new three-year performance period for all NEOs except Mr. Lewis. The amount for Mr. Lewis is the grant date value of performance cash units for the same three-year performance period, made prior to him becoming an officer of the Company. |

| (3) | Table of ContentsAll stock option grants awarded to NEOs vest ratably over four years, have a 10-year term, and are subject to stock ownership and post-exercise holding requirements. |

Sustainability and Corporate Responsibility> Highlights Of Our Environmental And Safety Achievements

PROXY STATEMENT

This proxy statement is being provided to shareowners in connection with the solicitation of proxies by the Board of Directors for use at the Annual Meeting of Shareowners of Honeywell International Inc. (“Honeywell” or the “Company”) to be held on Monday, April 23, 2018.

SUSTAINABILITY AND CORPORATE RESPONSIBILITY

Honeywell takes seriously its commitment to corporate social responsibility, protection of our environment, and creation of Sustainable Opportunity everywhere it operates.

Honeywell’s Sustainable Opportunity policy is based on the principle that by integrating health, safety, and environmental considerations into all aspects of its business, Honeywell:

•(4) | Protects its peopleRestricted stock units vest over six-year periods and are subject to stock ownership and post-vesting holding requirements. The grant to Mr. Lewis, made prior to him becoming an officer of the environment; | | | • | Achieves sustainable growth and accelerated productivity;Company, vests in three years. |

•(5) | Drives compliance with all applicable regulations;2018-2020 Performance Plan Units and | | | • | Develops technologies that expand the sustainable capacity of our world. Stock Options granted to Mr. Szlosek in 2018 were forfeited upon his retirement. |

Honeywell invents and manufactures technologies that address some of the world’s most critical challenges around energy, safety, security, productivity and global urbanization.

HIGHLIGHTS OF OUR ENVIRONMENTAL AND SAFETY ACHIEVEMENTS

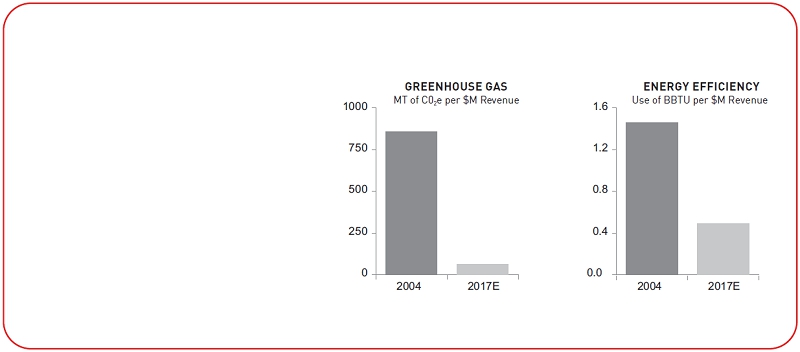

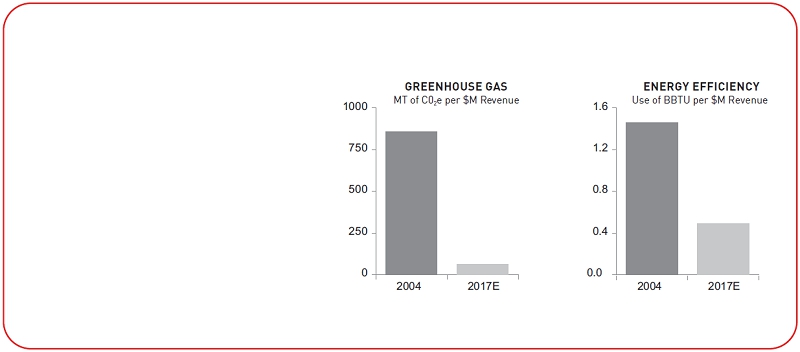

GREENHOUSE GAS REDUCTION AND ENERGY EFFICIENCY

Honeywell reports on its global greenhouse gas emissions publicly through CDP (formally Carbon Disclosure Project) and reports submitted to the U.S. Environmental Protection Agency and the United Kingdom Environment Agency. A qualified third party has provided limited assurance per ISO 14064-3 of Honeywell’s 2011-2016 Scope 1 and Scope 2 greenhouse gas emissions inventories.

• | Honeywell exceeded its first public goal to reduce global greenhouse gases by more than 30% and improve energy efficiency by more than 20% between 2004 and 2011. | | | | | | | | 6 | | | • | A second five-year goal, set to reduce greenhouse gas emissions by an additional 15% per dollar of revenue from 2011 levels, was met three years early. | |

| | | | Notice and Proxy Statement | 2019 | | | |

| | | • | By 2019, Honeywell will reduce its greenhouse gas emissions per dollar of revenue from 2013 levels by an additional 10%.01 | | | PROPOSAL 1: ELECTION OF DIRECTORS |

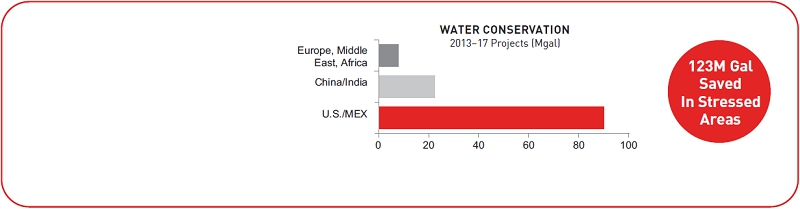

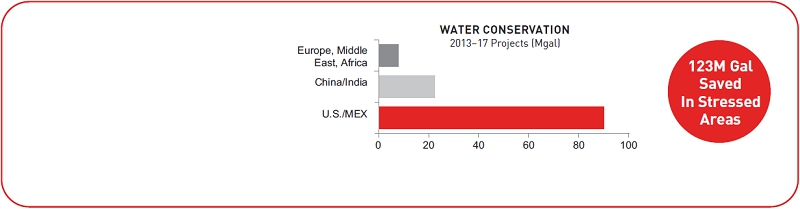

WATER

Honeywell has developed a global inventory of water usage in its manufacturing operations and implements water conservation projects in areas experiencing “water stress.”

Since 2013, the Company has implemented more than 130 water conservation projects in “water stressed” areas, saving over 120 million gallons.

2018 | Proxy and Notice of Annual Meeting of Shareowners |  | 1ELECTION OF DIRECTORS |

Sustainability and Corporate Responsibility> Highlights Of Our Environmental And Safety Achievements

SAFETY

Honeywell utilizes a comprehensive Health, Safety, Environment, Product Stewardship and Sustainability Management System based on recognized third-party standards, including ISO 14001 and OHSAS 18001, and industry best practices. The management system is fully integrated into the Honeywell Operating System, which drives continuous sustainable operational improvement. Compliance with standards and regulatory requirements is monitored through a company-wide, HSEPS-led audit process. The timely development and implementation of process improvements and corrective action plans are closely monitored.

Our global Total Case Incident Rate or “TCIR” (the numberCorporate Governance Guidelines set forth a clear vision statement for the composition of occupational injuriesHoneywell’s Board: “The composition of Honeywell’s Board, as well as the perspective and illnesses per 100 employees) was 0.45 atskills of its individual members, needs to effectively support Honeywell’s growth and commercial strategy. Collectively, the endBoard must also be capable of 2017. According to the U.S. Bureau of Labor Statistics, the weighted TCIR of the industries in which Honeywell participates is over 2.0. Honeywell has received worker safety awards from governmentsoverseeing risk management, capital allocation, and organizations around the world.

Health, Safety, Environment, Product Stewardship and Sustainability (“HSEPS”) Management System

Honeywell’s HSEPS matters are managed by a global team of trained professionals with extensive knowledge and hundreds of years of collective experience in occupational health, chemistry, hydrology, geology, engineering, safety, industrial hygiene, materials management and energy efficiency.

Honeywell’s Vice President of HSEPS reports to the Company’s Senior Vice President and General Counsel and has overall responsibility for HSEPS programs. A Corporate Energy & Sustainability Team, led by the Vice President of HSEPS, the Vice President of Global Real Estateleadership succession. Board composition and the Directormembers’ perspective and skills should evolve at an appropriate pace to meet the challenges of Sustainability, helps drive the Company’s sustainabilityHoneywell’s changing commercial and strategic goals. Progress on these goals is reported to Honeywell’s CEO on a monthly basis and is reviewed”

Consistent with the Board’s Corporate Governance and Responsibility Committee at least annually. Honeywell’s Integrity and Compliance program

Honeywell’s Integrity and Compliance program reflects ourthis vision, and values and helps our employees, representatives, contractors, consultants, and suppliers comply with a high standard of business conduct globally. At the core of the Integrity and Compliance program is the Company’s Code of Business Conduct (the “Code”) that applies across the Company in all businesses and in all countries. All employees are required to complete Code of Business Conduct training and certify that they will comply with the Code. In addition, managers and executives certify on an annual basis that they will act in accordance with the Code.

The Code is a baseline set of requirements that enables employees to recognize and be aware of how to report integrity, compliance, and legal issues. In addition, the Code outlines our pledge to recognize the dignity of each individual, respect each employee, provide compensation and benefits that are competitive, promote self-development through training that broadens work-related skills, and value diversity of perspectives and ideas. The Code provides guidance and outlines expectations in a number of key integrity and compliance areas, including how employees should treat each other, conflicts of interest, HSEPS, books and records, anti-corruption and proper business practices, trade compliance, insider trading, data privacy, respect for human rights, and the appropriate use of information technology and social media.

In addition to the Code, Honeywell’s Integrity and Compliance program provides comprehensive training on key compliance topics, develops training scenarios, provides mechanisms for employees and third parties to report concerns, and ensures timely and fair reviews of integrity and compliance concerns through a best-in-class process to report and investigate Code of Business Conduct concerns.

Moreover, the Integrity and Compliance program includes, among other elements, a supplier Code of Conduct that flows down to Honeywell’s global supply chain to reinforce Honeywell’s expectation that its suppliers will also abide by our high standards of integrity and compliance, including our Conflict Minerals, Anti-Human Trafficking, Business Integrity, and Health, Safety, and Environmental policies.

Honeywell Hometown Solutions

Honeywell demonstrates its commitment to corporate social responsibility and community involvement through Honeywell Hometown Solutions, which focuses on five important societal needs that align with Honeywell’s culture, products and people: safety and security, housing and shelter, math and science education, habitat and conservation, and humanitarian relief.

2 |  | Proxy and Notice of Annual Meeting of Shareowners | 2018 |

Political Contributions and Activities

These programs have delivered significant and meaningful results in communities around the world, including:

Offering academic opportunities that inspire students to pursue careers in science, technology, engineering and math (STEM), and providing teachers with new and innovative techniques to teach STEM education;

Partnering with environmental organizations to provide students with unique learning opportunities and teaching tools for educators to promote environmental science in the classroom;

Teaching parents and children potentially life-saving lessons to help avoid abduction and preventable childhood injuries;

Repairing homes and community centers for low-income families, the elderly and the disabled; and

Helping Honeywell employees and communities recover from natural disasters such as Hurricanes Harvey, Irma, Maria, Matthew and Sandy in the U.S.; wildfires in Alberta, Canada, and Colorado Springs; flooding in Louisiana and Romania; Super Typhoon Haiyan in the Philippines; the Great Japan Earthquake and Tsunami; and earthquakes in Mexico, Haiti and China.

For more information about our sustainability and corporate citizenship programs, please visit our website atwww.honeywell.com, and Corporate Citizenship athttp://citizenship.honeywell.com/.

POLITICAL CONTRIBUTIONS AND ACTIVITIES

Engagement in the political process is critical to our success. Our future growth depends on forward-thinking legislation and regulation that makes society safer and more energy efficient and improves public infrastructure. We strive to always engage responsibly in the political process and to ensure that our participation is fully consistent with all applicable laws and regulations, our principles of good governance, and our high standards of ethical conduct.

We have developed a strong team of government relations professionals based in Washington, D.C. who drive our lobbying programs and initiatives. Our government relations organization is led by the Senior Vice President, Global Government Relations. Members of the government relations organization work from a global network of offices.

MANAGEMENT AND BOARD OVERSIGHT

The law department oversees our lobbying activities. The Senior Vice President, Global Government Relations reports to the Company’s Senior Vice President and General Counsel (“General Counsel”) and also works closely with the Vice President, Global Compliance whose organization ensures compliance with our political spending policy. The General Counsel, Senior Vice President, Global Government Relations and Vice President, Global Compliance meet regularly with the Chairman and Chief Executive Officer and his leadership team about legislative, regulatory and political developments.

With respect to Board of Directors oversight, our public policy efforts, including all lobbying activities, political contributions and payments to trade associations and other tax-exempt organizations, is the responsibility of the Corporate Governance and Responsibility Committee (“CGRC”), which consists entirely(CGRC) has responsibility for identifying a slate of independent, non-employee directors. Each yeardirector nominees who collectively have the complementary experience, qualifications, skills, and attributes to guide the Company and function effectively as a Board.

The CGRC receives an annual report on the Company’s policies and practices regarding political contributions. The CGRC’s oversight of our political activities ensures compliance with applicable law and alignment with our policies and our Code of Business Conduct. In addition,believes that each year the Senior Vice President, Global Government Relations reports to the CGRC on trade association political spending and to the full Board of Directors on our global lobbying and government relations program. POLITICAL CONTRIBUTIONS

We have not made any political contributions using corporate funds since at least 2009 and have no present intention of making such political contributions in the future. Even before 2009, any such contributions were extremely rare and for minimal amounts of less than $5,000.

In 2013, we revised and expanded our disclosure on our policy and procedures for political activity and contributions. This disclosure is available on Honeywell’s website atwww.honeywell.com (see “Investors/Corporate Governance/Political Contributions”).

In 2017, the Center for Political Accountability (“CPA”), a non-profit, non-partisan organization, assessed our disclosure for its annual CPA-Zicklin Index of Corporate Political Disclosure and Accountability (“CPA-Zicklin Index”). The CPA-Zicklin Index measures the transparency, policies, and practices of the S&P 500. Our enhanced disclosure on political lobbying and contributions ranked usnominees presented in the “First Tier” of the 2017 CPA-Zicklin Index for the fourth year in a row. Our enhanced disclosure was also influenced by feedback received from our largest shareowners during our shareowner outreach initiative where we met with shareowners to discuss their views on several topics, including Honeywell’s disclosure on lobbying and political contributions.

For additional detail on Honeywell’s policies and processes on political contributions and lobbying, please see our response to Shareowner Proposal Number 6 onpages 86-88.

2018 | Proxy and Notice of Annual Meeting of Shareowners |  | 3 |

Shareowner Outreach and Engagement

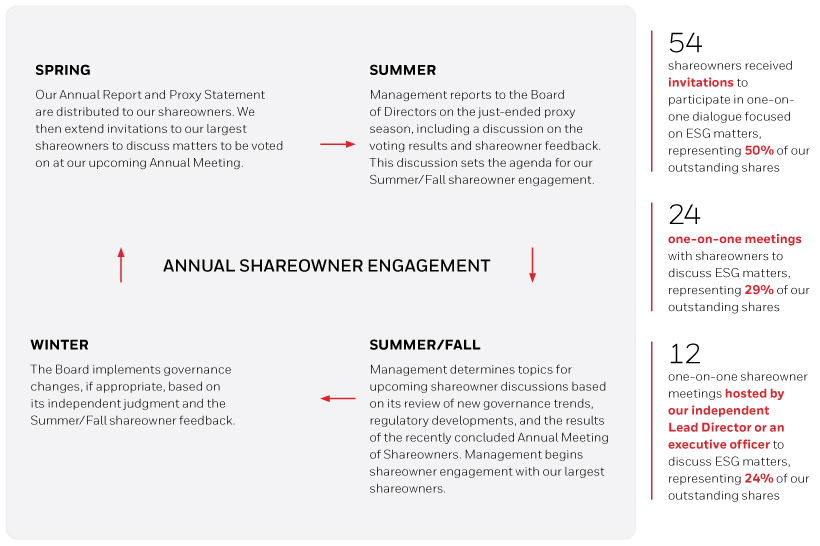

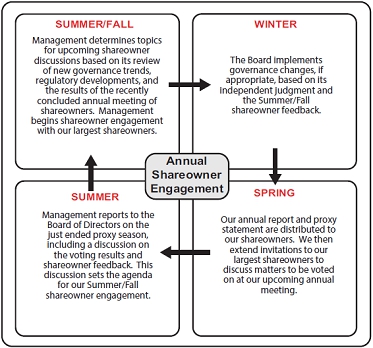

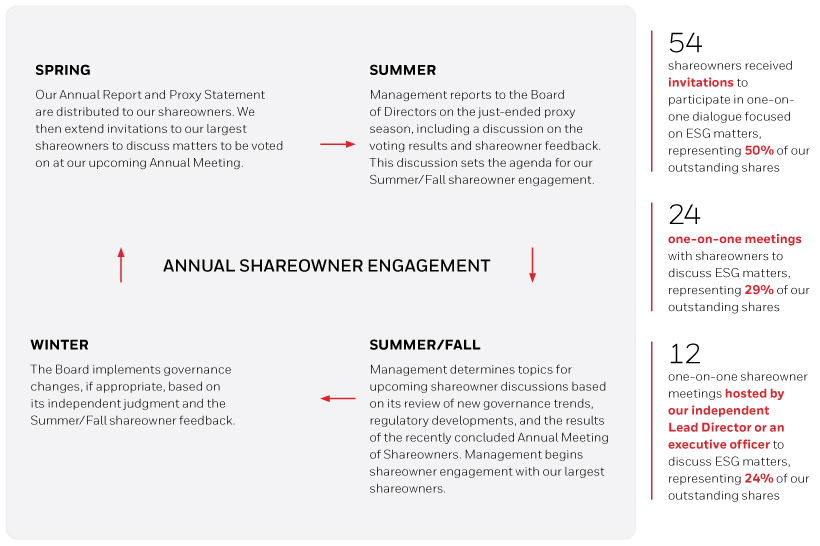

SHAREOWNER OUTREACH AND ENGAGEMENT

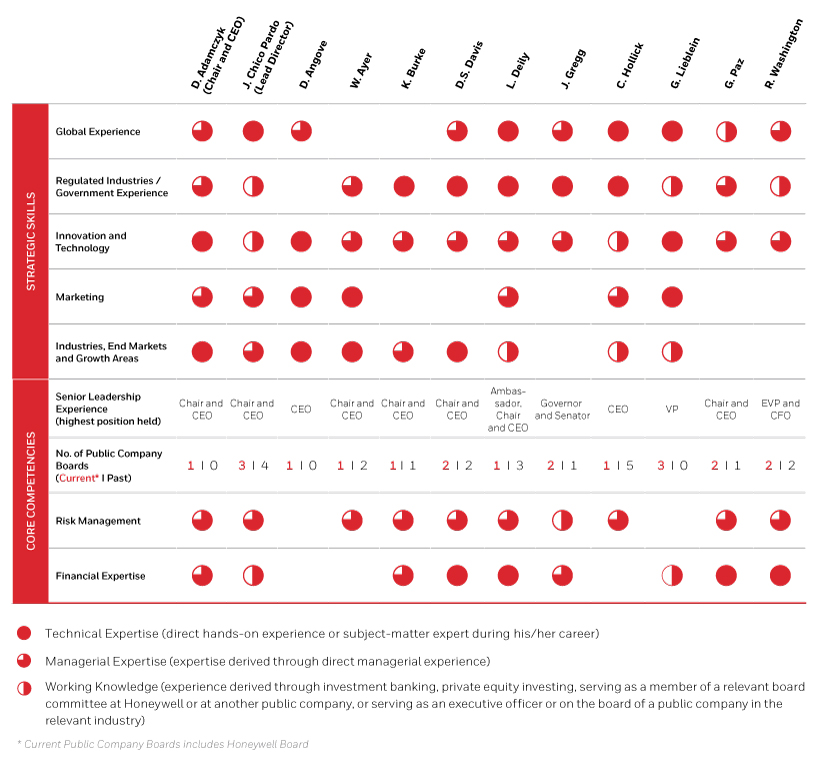

Understanding the issuesthis proxy has key personal attributes that are important to an effective board: integrity, candor, analytical skills, willingness to engage management and each other in a constructive and collaborative fashion, and ability and commitment to devote significant time and energy to service on the Board and its committees. The CGRC also considered the following specific experiences, qualifications, and skills, which Honeywell believes are critical in light of our shareownersstrategic priorities, and business objectives, operations, and structure.

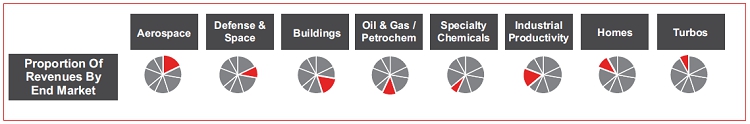

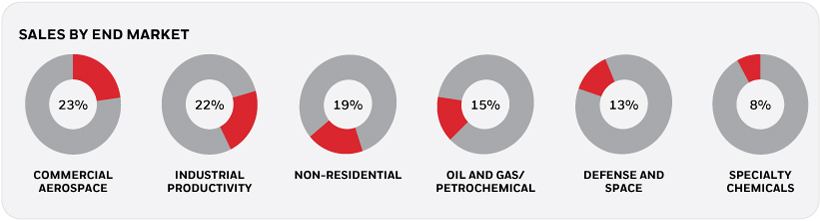

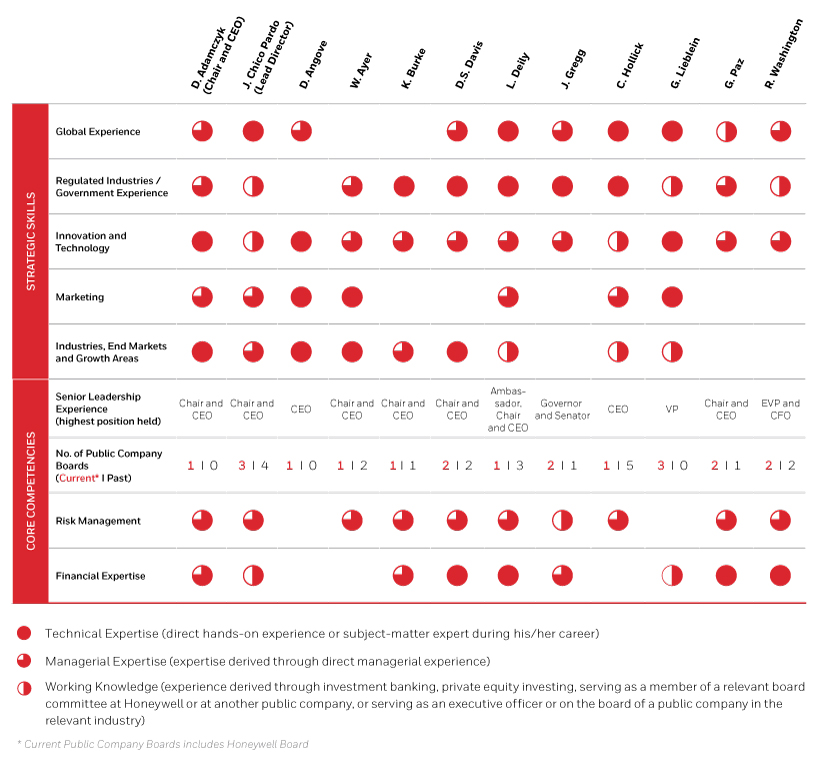

DIRECTOR SKILLS AND QUALIFICATIONS I STRATEGIC SKILLS Global Experience. Growing revenue outside of the United States, particularly in what we call “high growth regions” or “HGRs” such as China, India, Southeast Asia, Africa, and Latin America, is a central part of our long-term strategy for growth. Hence, exposure to markets and economies outside of the United States is an important qualification for our Board. This exposure can take many forms including government affairs, regulatory, managerial, or commercial. Regulated Industries/Government Experience.Honeywell is subject to a broad array of government regulations, and demand for its products and services can be impacted by changes in law or regulation in areas such as aviation safety, security, and energy efficiency. Several of our directors have experience in regulated industries, providing them with insight and perspective in working constructively and proactively with governments and agencies globally. Innovation and Technology.With Honeywell’s transformation to a software-industrial company in the digital age, expertise in combining software programming capabilities with leading-edge physical products and domain knowledge is critical to opening and securing new growth paths for all of Honeywell’s businesses. Marketing. Developing new markets for our products and services is critical for driving growth. Our directors who have that expertise provide a much desired perspective on how to better market and brand our products and services. Industries, End Markets, and Growth Areas.Experience in ensuringindustries, end markets, and growth areas that we address their interestsHoneywell serves – Commercial Aerospace, Industrial Productivity, Non-Residential, Oil and Gas / Petrochemical, Defense and Space, and Specialty Chemicals – enables a better understanding of the issues facing our businesses. I CORE COMPETENCIES Senior Leadership Experience.Experience serving as CEO or a senior executive as well as hands-on leadership experience in a meaningfulcore management areas, such as strategic and effective way. It is also foundational to good corporate governance. In that light, we engage with our shareowners on a regular basis to discuss a range of topics including our performance, strategy,operational planning, financial reporting, compliance, risk management, executive compensation, and leadership development, provide a practical understanding of complex organizations like Honeywell. Public Company Board Experience.Service on the boards and board committees of other public companies provides an understanding of corporate governance.governance practices and trends and insights into board management, relations between the board, the CEO and senior management, agenda setting, and succession planning. Risk Management. In light of the Board’s role in risk oversight and our robust Enterprise Risk Management program, we seek directors who can help identify, manage, and mitigate key risks, including cybersecurity, regulatory compliance, competition, financial, brand integrity, human capital, and intellectual property. Financial Expertise. We recognize the valuebelieve that an understanding of taking our shareowners’ views into account. Dialoguefinance and engagement with our shareowners helps us understand how they view us, set goals and expectationsfinancial reporting processes is important for our performance,directors to enable them to monitor and identify emerging issues that may affect our strategies, corporate governance, compensation practices or other aspects of our operations. Our shareownerassess the Company’s operating and investor outreach and engagement takes many forms and is a year-round activity. We participate in numerous investor conferences and analyst meetings, hold our own investor events, some of which focus on individual businesses held at our facilities, and meet one-on-one with shareowners in a variety of contexts and forums. We also communicate with shareowners and other stakeholders through various media, including our annual report and SEC filings, proxy statement, news releases, and our website. We hold conference calls for our quarterly earnings releases and other major corporate events which are open to all. These calls are available in real time and as archived webcasts on our website.

Our Chairman, CEO, Chief Financial Officer, Vice President of Investor Relations and other senior management meet frequently with investors to discuss Honeywell’s strategy, financial and businessstrategic performance and to update investors on key developments. In addition, members of our Board, including our Lead Director, the Chair of our Corporate Governanceensure accurate financial reporting and Responsibility Committee (“CGRC”),robust controls. We seek directors with background and the Chair of our Management Developmentexperience in capital markets, corporate finance, accounting, and Compensation Committee (“MDCC”) meet with our large shareowners to discuss a range of issues including executive compensation and corporate governance.

GOVERNANCE AND COMPENSATION OUTREACH

Given the significant changes that occurred at Honeywell in the past year, our shareowner engagement during 2017 was particularly robust. We held 36 meetings with shareowners during the course of 2017 (representing approximately 36% of the shares outstanding) to discuss a wide range of governance and compensation issues, including:

• The ’Say on Pay’ vote which occurred at our 2017 annual meeting;

• Progress on the implementation of our CEO succession plan (seepage 13 for a description of the Board’s decision on whether to separate the roles of Chairman and CEO);

• The announcement in early 2017 of our intent to conduct a comprehensive portfolio review and the process we intend to employ;

• The subsequent conclusion of that portfolio review in October 2017 when we announced our intent to spin-off two significant business units and how we reached that conclusion;

• Significant improvements to our Corporate Governance Guidelines intended to facilitate ongoing Board refreshment which we describe onpage 12; and

• Whether to separate the roles of Chairman and CEO when our current Chairman, David M. Cote, retires in April 2018.

What we heard from our investors:

During our many shareowner interactions on the topics described above, we heard a diverse range of views. In general, our investors appreciated our transparency and the willingness by our senior executives and members of the Board to engage with, and listen to, shareowners. We summarize the feedback we heard below:

• Near universal satisfaction with the changes we made to our executive compensation programs prior to the 2017 annual meeting of shareowners, which resulted in approximately 93% of our shareowners voting in favor of ’Say on Pay’;

• Support for the portfolio review process undertaken by Honeywell management and overseen by the Board, which resulted in our announcement on October 10, 2017 to spin off our Homes product portfolio and ADI global distribution business,financial reporting as well as our Transportation Systems business, into two stand-alone, publicly-traded companies;

4 |  | Proxy and Notice of Annual Meeting of Shareowners | 2018 |

Shareowner Outreach and Engagement> Governance and Compensation Outreachdirectors with “accounting or related financial management expertise” as defined in the New York Stock Exchange listing standards.

• | A range of views on whether the roles of Chairman and CEO should be recombined when our current Chairman, David M. Cote, retires as Executive Chairman at the April 2018 Annual Meeting of Shareowners. The majority of shareowners expressed the view that in light of Honeywell’s past and current financial and governance performance, the Honeywell Board should decide whether to separate the roles based on its assessment of what governance structure best serves the long-term interests of shareowners. A minority expressed the view that the roles of Chairman and CEO should be separate as a matter of best practice. Seepage 13 for a description of the Board’s decision on whether to separate the roles of Chairman and CEO; and |

| • | Widespread approval of the improvements we made to our Corporate Governance Guidelines intended to facilitate ongoing Board refreshment which we describe onpage 12. | | |

| | | Notice and Proxy Statement | 2019 | | 7 |

COMMUNICATING WITH MANAGEMENT AND INVESTOR RELATIONS

Our Investor Relations department is the primary point of contact for shareowner interaction with Honeywell. Shareowners should write to or call:

| | | | 01 | | | Mark Macaluso

Vice President, Investor Relations

Honeywell

115 Tabor Road, Morris Plains, NJ 07950

Phone: +1 (973) 455-2222PROPOSAL NO. 1:

Visit our website atwww.investor.honeywell.com

We encourage our shareowners to visit the Investors section of our website for more information on our investor relations and corporate governance programs.ELECTION OF DIRECTORS

|

BOARD SKILLSET MATRIX In 2018, we adopted a Board skills and experience matrix to facilitate the comparison of our directors’ skills versus those skills deemed necessary to oversee our current strategy. We continue to refresh the matrix, and the skills included in the matrix are evaluated against our articulated strategy so that it can serve as an effective tool for identifying director nominees who collectively have the complementary experience, qualifications, skills, and attributes to guide our Company. Our 2019 Board skillset matrix is set forth below.

| | | | | | | | | PROCESS FOR COMMUNICATING WITH BOARD MEMBERS8

| |

| | | | Notice and Proxy Statement | 2019 | | | |

| | | | 01 | | | Shareowners, as well as other interested parties, may communicate directly with the Lead Director for an upcoming meeting, the non-employee directors as a group, or individual directors by writing to:PROPOSAL NO. 1:

Honeywell

c/o Corporate Secretary

115 Tabor Road

Morris Plains, NJ 07950

Honeywell’s Corporate Secretary reviews and promptly forwards communications to the directors as appropriate. Communication involving substantive accounting or auditing matters are forwarded to the Chair of the Audit Committee. Certain items that are unrelated to the duties and responsibilities of the Board will not be forwarded such as: business solicitation or advertisements; product or service related inquires; junk mail or mass mailings; resumes or other job-related inquires; spam and overly hostile, threatening, potentially illegal or similarly unsuitable communications.ELECTION OF DIRECTORS

|

2018 | Proxy and Notice of Annual Meeting of Shareowners |  | 5 |

COMMITMENT TO BOARD INTEGRITY, DIVERSITY, AND INDEPENDENCE In addition to ensuring that our director nominees possess the requisite skills and qualifications, the CGRC places an emphasis on ensuring that the nominees demonstrate the right leadership traits, personality, work ethic, independence, and diversity of background to align with our performance culture and our long-term strategic vision. Specifically, these criteria include: Exemplification of the highest standards of personal and professional integrity Proposal No. 1: Election

Potential contribution to the diversity and culture of Directors> Director Nominations-Skillsthe Board, including by virtue of age, educational background, global perspective, gender, ethnicity, and Criterianationality Independence from management under applicable securities law, listing regulations, and Honeywell’s Corporate Governance Guidelines Willingness to constructively challenge management through active participation in Board and committee meetings Ability to devote sufficient time to performing their Board and committee duties While Honeywell’s Corporate Governance Guidelines do not prescribe a diversity policy or standards, as a matter of practice, we are committed to enhancing both the diversity of the Board itself and the perspectives and values that are discussed in Board and committee meetings. Our current Board composition reflects this approach and the Board’s commitment to diversity. The CGRC also believes that, in addition to diversity of personal characteristics, and experiences, diversity of service tenures on the Honeywell Board also facilitates effective Board oversight. Directors with many years of service to Honeywell provide the Board with a deep knowledge of our Company, while newer directors lend fresh perspectives. Hence, careful consideration is made to achieve the appropriate balance.

PROPOSAL NO. 1:NOMINATION AND ELECTION OF DIRECTORS

PROCESS Honeywell’s directors are elected at each Annual Meeting of Shareowners and hold office for one-year terms or until their successors are duly elected and qualified. Honeywell’s By-laws provide that in any uncontested election of directors (an election in which the number of nominees does not exceed the number of directors to be elected), any nominee who receives a greater number of votes cast “FOR” his or her election than votes cast “AGAINST” his or her election will be elected to the Board of Directors. The Board has nominated 12 candidates for election as directors. If any nominee should become unavailable to serve prior to the Annual Meeting, the shares represented by a properly signed and returned proxy card or voted by telephone, via the Internet or by scanning the QR code will be voted for the election of such other person as may be designated by the Board. The Board may also determine to leave the vacancy temporarily unfilled or reduce the authorized number of directors in accordance with the By-laws. In 2017, the mandatory retirement age for directors was increased from 72 to 75. The retirement age increase was implemented to ensure Board continuity during a successful CEO succession process that the Board implemented in 2017 and during a period where we are undertaking a major portfolio realignment, including the spin-offs of two significant business units. As a result, directors may serve until the Annual Meeting of Shareowners immediately following their 75th birthday. For further detail on the increase in the mandatory retirement age, see “Summary of Improvements To Our Governance Guidelines in 2017” onpage 12.

DIRECTOR NOMINATIONS — SKILLS AND CRITERIA

The Corporate Governance and Responsibility Committee (“CGRC”) is responsible for nominating a slate of director nominees who collectively have the complementary experience, qualifications, skills and attributes to guide the Company and function effectively as a Board. In 2017, the Board reviewed its processes and procedures for nominating directors to ensure that the skills, experience and perspective of the Board, and the Board’s ability to periodically refresh those attributes, keeps pace with an evolving commercial strategy focused on Honeywell becoming a world-leading software industrial company. As a result of that review, the Board updated its Corporate Governance Guidelines so that director nominations are now subject to the following:

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. |

Before recommending for re-nomination a slate of incumbent directors for an additional term, the Corporate Governance and Responsibility Committee will evaluate whether incumbent directors possess the requisite skills and perspective, both individually and collectively.

With respect to the recruitment of new members, the Corporate Governance and Responsibility Committee has the responsibility for periodically identifying and recruiting new members to the Board.

As and when the Board considers adding new members, the Lead Director, CEO, Chairman and the Chair of the Corporate Governance and Responsibility Committee work together to identify and prioritize the specific skill sets, experience, and knowledge that candidates for election to the Board must possess.

Candidates are interviewed multiple times by the Chairman, CEO, Lead Director and other members of the Board to ensure that candidates not only possess the requisites skills and characteristics but also the personality, leadership traits, work ethic, and independence to effectively contribute as a member of the Board.

After this process, the Board nominates the successful candidate for election to the Board at the Annual Meeting of Shareowners. From time to time, the Board fills vacancies in its membership, using the same process described above, which arise between annual meetings of shareowners.

The CGRC believes that each of the nominees presented in this proxy has key personal attributes that are important to an effective board: integrity, candor, analytical skills, the willingness to engage management and each other in a constructive and collaborative fashion, and the ability and commitment to devote significant time and energy to service on the Board and its Committees.

The following list highlights other key experiences, qualifications and skills of our director nominees that are relevant and important in light of Honeywell’s businesses and structure.

6 |  | | | | |

| | | Notice and Proxy and Notice of Annual Meeting of Shareowners Statement |2018 2019 | | 9 |

Proposal No. 1: Election of Directors> Director Nominations-Skills and Criteria

DIRECTOR SKILLS AND QUALIFICATIONS CRITERIA

PROPOSAL NO. 1: Senior Leadership ExperienceELECTION OF DIRECTORS

Experience serving as CEO or a senior executive as well as hands-on leadership experience in core management areas, such as strategic and operational planning, financial reporting, compliance, risk management and leadership development provides a practical understanding of how complex organizations like Honeywell function.

Industry

Experience in industries, end-markets and growth segments that Honeywell serves, such as aerospace, automotive, construction, transportation, infrastructure, oil and gas, security and fire, energy efficiency and worker productivity and safety enables a better understanding of the issues facing our businesses.

Global Experience

Growing revenues outside of the United States, particularly in what we call “high growth regions” or “HGRs” such as China, India, Southeast Asia, Africa and Latin America is a central part of our long-term strategy for growth. Hence, exposure to markets and economies outside of the United States, particularly in HGRs, is an important qualification for our Board. This exposure can take many forms including government affairs, regulatory, managerial, commercial, linguistic or simply cultural.

Financial Expertise

We believe that an understanding of finance and financial reporting processes is important for our directors to monitor and assess the Company’s operating and strategic performance and to ensure accurate financial reporting and robust controls. Our director nominees have relevant background and experience in capital markets, corporate finance, accounting and financial reporting and several satisfy the “accounting or related financial management expertise” criteria set forth in the New York Stock Exchange (“NYSE”) listing standards.

Regulated Industries/Government Experience

Honeywell is subject to a broad array of government regulations, and demand for its products and services can be impacted by changes in law or regulation in areas such as safety, security and energy efficiency. Several of our directors have experience in regulated industries, providing them with insight and perspective in working constructively and proactively with governments and agencies globally.

Public Company Board Experience

Service on the boards and board committees of other public companies provides an understanding of corporate governance practices and trends and insights into board management, relations between the board, the CEO and senior management, agenda setting and succession planning.

Risk Management

In light of the Board’s role in risk oversight and our robust enterprise risk management program, we seek directors who can help manage and mitigate key risks, including cybersecurity, regulatory compliance, competition, financial, brand integrity and intellectual property risks.

Innovation and Technology

With Honeywell’s transformation to a software-industrial company in the digital age, expertise in combining software programming capabilities with leading-edge physical products and domain knowledge is critical to opening and securing new growth paths for all of Honeywell’s businesses.

Marketing

Developing new markets for our products and services is critical for driving growth. Our directors who have that expertise provide a much desired perspective on how to better market and brand our products and services.

|

Each of the nominees, other than Mr. Adamczyk, is independent of the Company and management. See “Director Independence” onpage 21 of this proxy statement.

The CGRC also considered the specific experience described in the biographical details that follow in determining to nominate the following individuals for election as directors.

The Board of Directors unanimously recommends a vote FOR the election of each of the director nominees.

2018 | Proxy and Notice of Annual Meeting of Shareowners |  | 7 |

Proposal No. 1: Election of Directors> Nominees for Election

NOMINEES FOR ELECTION DARIUS ADAMCZYK, President and Chief Executive Officer of Honeywell International Inc.

| | | | | | | | | YearsDARIUS

ADAMCZYK Chairman and Chief Executive Officer, Honeywell International Inc. | | About Mr. Adamczyk has been the Chairman and Chief Executive Officer of Service: 1

Age: 52

|

Mr. Adamczyk is the President and Chief Executive Officer of Honeywell since March 2017. He will become Chairman upon Mr. Cote’s retirement at the 2018 Annual Meeting of Shareowners. Mr. Adamczyk was President and Chief Operating Officer from April 2016 to March 2017. From April 2014 to April 2016, Mr. Adamczyk served as President and CEO of Honeywell Performance Materials and Technologies (“PMT”). Prior to serving as President and CEO of PMT, Mr. Adamczyk served as President of Honeywell Process Solutions from 2012 to 2014. When he joined Honeywell in 2008, he became President of Honeywell Scanning & Mobility from 2008 to 2012. Mr. Adamczyk began at Honeywell when Metrologic, Inc., where he was the Chief Executive Officer, was acquired by Honeywell. Prior to joining Honeywell, Mr. Adamczyk held several general management assignments at Ingersoll Rand, served as a senior associate at Booz Allen Hamilton, and started his career as an electrical engineer at General Electric.

| | |

| | Specific Qualifications, Attributes, Skills, and Experience • | Senior leadership roles in global organizations, both large and small | • | Deep understanding of software, both technically and commercially, and a proven track record in growing software-related businesses at Honeywell | • | Demonstrated ability to deliver financial results as a leader in a variety of different industries, with disparate business models, technologies, and customers | • | Strategic leadership skills necessary to grow Honeywell revenuessales organically and inorganically while meeting the challenges of a constantly changing environment across Honeywell’s diverse business portfolio |

DUNCAN B. ANGOVE, President of Infor, Inc.

Years of Service: 0

Age: 51

| | | | | | | | | | | | | | DUNCAN B. ANGOVE • Management Development & CompensationChief Executive Officer

and Managing Partner, Warmaug Partners LLC

• Retirement Plans

| | About

Since 2018, Mr. Angove has been CEO and Managing Partner of Warmaug Partners LLC, a private equity firm focused on delivering superior financial returns through the application of financial capital and digital transformation. Previously, from 2010 to 2018, Mr. Angove was President of Infor, Inc., a privately held provider of enterprise software and a strategic technology partner for more than 90,000 organizations worldwide. Infor’s software is purpose-built for specific industries, from manufacturing to healthcare, providing complete suites that are designed to support end-to-end business processes and digital transformation. Previously, Mr. Angove served as the Senior Vice President and General Manager of the Retail Global Business Unit for Oracle Corporation, a global technology provider of enterprise software, hardware, and services, from 2005 to 2010. He joined Oracle through its acquisition of Retek Inc., then a publicly traded provider of software solutions and services to the retail industry, where he served in various roles of increasing responsibility from 1997 until 2005. |

Since 2010, Mr. Angove has been President of Infor, Inc., a privately-held provider of enterprise software and a strategic technology partner for more than 90,000 organizations worldwide. The software is purpose-built for specific industries, from manufacturing to healthcare, providing complete suites that are designed to support end-to-end business processes and digital transformation. Previously, Mr. Angove served as the Senior Vice-President and General Manager of the Retail Global Business Unit for Oracle Corporation, a global technology provider of enterprise software, hardware and services, from 2005 to 2010. He joined Oracle through its acquisition of Retek Inc., then a publicly-traded provider of software solutions and services to the retail industry, where he served in various roles of increasing responsibility from 1997 until 2005.

| | |

| | Specific Qualifications, Attributes, Skills, and Experience • | Senior technology industry leader with global operating experience including in software and digital transformation | • | Deep understanding of the trends across enterprise cloud, infrastructure software, digital, and the internetInternet of thingsThings, and skilled at driving value creation | • | Extensive experience in corporate strategy, M&A, sales, marketing, and business and product development |

| | | | |

| | | | | | | | | 10 | |

| | | | Notice and Proxy Statement | 2019 | | | |

| | | | 01 | | | PROPOSAL NO. 1: ELECTION OF DIRECTORS |

WILLIAM S. AYER, Retired Chairman and Chief Executive Officer of Alaska Air Group, Inc. (Alaska Air Group)

| | | | | | | | | WILLIAM S. AYER Retired Chairman and

Chief Executive Officer, Alaska Air Group, Inc. | | Years of Service: 3

Age: 63About

Mr. Ayer is the retired Chairman of the Board Committees: • Corporate Governance & Responsibility

• Management Development & Compensation

|

Mr. Ayer is the retired Chairman of the Board and Chief Executive Officer of Alaska Air Group, the parent company of Alaska Airlines and its sister carrier, Horizon Air. Mr. Ayer served as Chief Executive Officer of Alaska Air Group and its subsidiaries through 2012, and as Chairman through 2013. A veteran of more than three decades in aviation, Mr. Ayer began his career with Horizon Air in 1982 where he held a variety of marketing and operations positions. He joined Alaska Airlines in 1995 as Vice President of Marketing and Planning, and subsequently held the posts of Senior Vice President, Chief Operating Officer, and President. In 2002, he became Alaska Air Group’s Chief Executive Officer, and, in May 2003, he was appointed Chairman. Mr. Ayer was a director of Puget Sound Energy, Inc. and Puget Energy, Inc. from January 2005 until January 2015 and served as Chairman from January 2009 until January 2015.

| | |

| | Specific Qualifications, Attributes, Skills, and Experience • | Deep aerospace industry knowledge as well as sales, marketing, and operations experience through his three decades of leadership roles at Alaska Air Group, recognized for its best-in-class operating metrics among U.S. air carriers | • | Proven leadership skills in developing a business enterprise that can deliver long-term, sustained excellence based on a management style that includes a relentless focus on the customer, continuous improvement, and building a culture of safety, innovation, sustainability, and diversity | • | Understanding of the U.S. public utility industry through his service as a director on the Board of Puget Energy |

|  | | | | | | | | | | | | | | KEVIN BURKE

Leadership |

Industry |

Global |

Financial |

Government |

Public Company |

Risk Management |

Technology |

Marketing |

Retired Chairman, 8 |  | ProxyPresident and Notice of Annual Meeting of Shareowners | 2018 |

Proposal No. 1: Election of Directors> Nominees for Election

Chief Executive Officer, Consolidated Edison, Inc. KEVIN BURKE, Retired Chairman, President and Chief Executive Officer of Consolidated Edison, Inc. (Con Edison)

| | Years of Service: 8

Age: 67About

Mr. Burke joined Consolidated Edison, Inc. (Con Edison), a utility provider of electric, gas, and steam services, in 1973 and held positions of increasing responsibility in system planning, engineering, law, nuclear power, construction, and corporate planning. He served as Senior Vice President from July 1998 to July 1999, with responsibility for customer service and for Con Edison’s electric transmission and distribution systems. In 1999, Mr. Burke was elected President of Orange and Rockland Utilities, Inc., a subsidiary of Con Edison. He was elected President and Chief Operating Officer of Consolidated Edison Company of New York, Inc., in 2000 and elected Chief Executive Officer in 2005. Mr. Burke served as President and Chief Executive Officer of Con Edison from 2005 through 2013, and was elected Chairman in 2006. Mr. Burke became non-executive Chairman of Con Edison in December 2013 and served in that capacity until April 2014. Mr. Burke was a member of the Board Committees: • Audit

• Retirement Plans

|

Mr. Burke joined Con Edison, a utility provider of electric, gas and steam services, in 1973 and held positions of increasing responsibility in system planning, engineering, law, nuclear power, construction, and corporate planning. He served as Senior Vice President from July 1998 to July 1999, with responsibility for customer service and for Con Edison’s electric transmission and distribution systems. In 1999, Mr. Burke was elected President of Orange & Rockland Utilities, Inc., a subsidiary of Con Edison. He was elected President and Chief Operating Officer of Consolidated Edison Company of New York, Inc. in 2000 and elected Chief Executive Officer in 2005. Mr. Burke served as President and Chief Executive Officer of Con Edison from 2005 through 2013, and was elected Chairman in 2006. Mr. Burke became non-executive Chairman of Con Edison in December 2013 and served in that capacity until April 2014. Mr. Burke was a member of the Board of Directors of Con Edison and a member of the Board of Trustees of Consolidated Edison Company of New York, Inc. which is a subsidiary of Con Edison, until May 2015.

| | |

| | Specific Qualifications, Attributes, Skills, and Experience • | Extensive management expertise gained through various executive positions, including senior leadership roles, at Con Edison | • | Wealth of experience in energy production and distribution, energy efficiency, alternative energy sources, engineering and construction, government regulation, and development of new service offerings | • | Significant expertise in developing clean and renewable energy infrastructure technology used in clean energy, solar generation, and other energy efficient products and services | • | Oversaw the implementation of financial and management information systems, utility operational systems, and process simulators | • | Deep knowledge of corporate governance and regulatory issues facing the energy, utility, and service industries |  | | | | |

JAIME CHICO PARDO, President and Chief Executive Officer, ENESA, S.A. de C.V. (ENESA)

| | | | |

| | Years of Service: 18

Age: 68| Notice and Proxy Statement | 2019

| | 11 |

| | | | 01 | | | PROPOSAL NO. 1: ELECTION OF DIRECTORS |

| | | | | | | | | JAIME CHICO PARDO Lead DirectorPresident and

Chief Executive Officer, ENESA, S.A. de C.V. | | About Ex officio memberMr. Chico Pardo has been President and Chief Executive Officer of eachENESA, S.A. de C.V. (ENESA), a private fund investing in the Mexican energy and health care sectors since March 2010. He previously served as Co-Chairman of the Board Committeeof Telefonos de Mexico, S.A.B. de C.V. (TELMEX), a telecommunications company based in Mexico City, from April 2009 until April 2010, as its Chairman from October 2006 to April 2009, and as its Vice Chairman and Chief Executive Officer from 1995 until 2006. Mr. Chico Pardo was Co-Chairman of the Board of Impulsora del Desarrollo y el Empleo en América Latina, S.A. de C.V., a publicly listed company in Mexico engaged in investment in and management of infrastructure assets in Latin America, from 2006 until 2010. He also was Chairman of Carso Global Telecom, S.A. de C.V. from 1996 until 2010. Prior to joining TELMEX, Mr. Chico Pardo served as President and Chief Executive Officer of Grupo Condumex, S.A. de C.V. and Euzkadi/General Tire de Mexico, manufacturers of products for the construction, automotive, and telecommunications industries. Mr. Chico Pardo also has spent a number of years in the international and investment banking business. Mr. Chico Pardo is a director of Grupo Bimbo, S.A.B. de C.V. and PROMECAP Acquisition Company, S.A.B. de C.V. He previously served as a director of AT&T (2008-2015), Grupo Carso, S.A. de C.V. and several of its affiliates (1991-2013), three mutual funds in the American Funds family of mutual funds (2011-2013) and Honeywell Inc. from September 1998 to December 1999.

| | | |

| | Specific Qualifications, Attributes, Skills, and Experience

|

Mr. Chico Pardo has been President and Chief Executive Officer of ENESA, a private fund investing in the Mexican energy and health care sectors since March 2010. He previously served as Co-Chairman of the Board of Telefonos de Mexico, S.A.B. de C.V. (TELMEX), a telecommunications company based in Mexico City, from April 2009 until April 2010 and as its Chairman from October 2006 to April 2009 and its Vice Chairman and Chief Executive Officer from 1995 until 2006. Mr. Chico Pardo was Co-Chairman of the Board of Impulsora del Desarrollo y el Empleo en América Latina, S.A. de C.V., a publicly listed company in Mexico engaged in investment in and management of infrastructure assets in Latin America, from 2006 until 2010. He was also Chairman of Carso Global Telecom, S.A. de C.V. from 1996 until 2010. Prior to joining TELMEX, Mr. Chico Pardo served as President and Chief Executive Officer of Grupo Condumex, S.A. de C.V. and Euzkadi/General Tire de Mexico, manufacturers of products for the construction, automotive and telecommunications industries. Mr. Chico Pardo has also spent a number of years in the international and investment banking business. Mr. Chico Pardo is a director of Grupo Bimbo, S.A.B. de C.V. He previously served as a director of AT&T (2008-2015), Grupo Carso, S.A. de C.V. and several of its affiliates (1991-2013), three mutual funds in the American Funds family of mutual funds (2011-2013) and Honeywell Inc. from September 1998 to December 1999.

Specific Qualifications, Attributes, Skills and Expertise

• | Broad international exposure through senior leadership roles in Latin American companies in the telecommunications, automotive, manufacturing, engineering, and construction industries | • | Expertise in the management of infrastructure assets and international business, operations, and finance focused on Latin America | • | Broad experience with investment strategies in innovation and technology to support the energy, healthcare, and telecommunications industries in Mexico and Latin America | • | Enhanced perspectives on corporate governance, risk management, and other issues applicable to public companies |

D. SCOTT DAVIS, Retired Chairman and Chief Executive Officer of United Parcel Service, Inc. (UPS)

| | | |  | | | | | | | | | | | | | | | | | | | D. SCOTT DAVIS Retired Chairman and Chief Executive Officer, United Parcel Service, Inc. | | Years of Service: 12

Age: 66About

Mr. Davis joined United Parcel Service, Inc. (UPS), a leading global provider of package delivery, specialized transportation, and logistics services in 1986. He served as the non-Executive Chairman of UPS from September 2014 until May 2016. Prior to his retirement as Chief Executive Officer of UPS, Mr. Davis served as Chairman and Chief Executive Officer from January 1, 2008 to September 2014. Prior to this, he served as Vice Chairman since December 2006 and as Senior Vice President, Chief Financial Officer and Treasurer since January 2001. Previously, Mr. Davis held various leadership positions with UPS, primarily in the finance and accounting areas. During his tenure at UPS, Mr. Davis served a critical role in helping UPS to reinvent itself into a technology company. Prior to joining UPS, he was Chief Executive Officer of II Morrow Inc., a technology company and developer of general aviation and marine navigation instruments. Mr. Davis is a Certified Public Accountant. He also is a director of Johnson and Johnson. Mr. Davis previously served on the Board Committees: •Management Development & Compensation Committee Chairperson

•Audit

of the Federal Reserve Bank of Atlanta (2003-2009), serving as Chairman in 2009, and as a director of EndoChoice Holdings (2015-2016).

|

Mr. Davis joined UPS, a leading global provider of package delivery, specialized transportation and logistics services in 1986. He served as the non-Executive Chairman of UPS from September 2014 until May 2016. Prior to his retirement as Chief Executive Officer of UPS, Mr. Davis served as Chairman and Chief Executive Officer from January 1, 2008 to September 2014. Prior to this, he served as Vice Chairman since December 2006 and as Senior Vice President, Chief Financial Officer and Treasurer since January 2001. Previously, Mr. Davis held various leadership positions with UPS, primarily in the finance and accounting areas. During his tenure at UPS, Mr. Davis served a critical role in helping UPS to reinvent itself into a technology company as well as transportation. Prior to joining UPS, he was Chief Executive Officer of II Morrow Inc., a technology company and developer of general aviation and marine navigation instruments. Mr. Davis is a Certified Public Accountant. He is also a director of Johnson & Johnson. Mr. Davis previously served on the Board of the Federal Reserve Bank of Atlanta (2003-2009), serving as Chairman in 2009, and EndoChoice Holdings (2015-2016).

| | |

| | Specific Qualifications, Attributes, Skills, and Experience • | Significant expertise in management, strategy, finance, and operations gained over 25 years at UPS including through senior leadership roles | • | Financial management expertise, including financial reporting, accounting, and controls | • | Strong banking experience and a deep understanding of public policy and global economic indicators | • | Extensive experience in the transportation and logistics services industry | • | In-depth understanding of technology and software solutions that support automated and web-based shipping, tracking, and specialized transportation Logisticslogistics |

| | | | |

| | |

Marketing01 | | | PROPOSAL NO. 1: ELECTION OF DIRECTORS |

2018 | Proxy and Notice of Annual Meeting of Shareowners |  | 9 | | | | | | | |

Proposal No. 1: Election of Directors> Nominees for Election

LINNET F. DEILY, Former Deputy U.S. Trade Representative and Ambassador

Years of Service: 12

Age: 72LINNET F.

DEILY Board Committees:Former

• Corporate Governance & Responsibility Committee Chairperson

• AuditDeputy U.S. Trade Representative and Ambassador

|

Ms. Deily was Deputy U.S. Trade Representative and U.S. Ambassador to the World Trade Organization from 2001 to 2005. From 2000 until 2001, she was Vice Chairman of The Charles Schwab Corp. Ms. Deily served as President of the Schwab Retail Group from 1998 until 2000 and President of Schwab Institutional-Services for Investment Managers from 1996 to 1998. Prior to joining Schwab, she was the Chairman of the Board, Chief Executive Officer and President of First Interstate Bank of Texas from 1990 until 1996. She is also a director of Chevron Corporation.

| About Ms. Deily was Deputy U.S. Trade Representative and U.S. Ambassador to the World Trade Organization from 2001 to 2005. From 2000 until 2001, she was Vice Chairman of The Charles Schwab Corp. Ms. Deily served as President of the Schwab Retail Group from 1998 until 2000 and President of Schwab Institutional-Services for Investment Managers from 1996 to 1998. Prior to joining Schwab, she was the Chairman of the Board, Chief Executive Officer, and President of First Interstate Bank of Texas from 1990 until 1996. She retired as a director of Chevron Corporation in May 2018. | | | |

| | Specific Qualifications, Attributes, Skills, and Experience • | Unique global and governmental perspectives regarding international trade, capital markets, public policy, telecommunications, information services, corporate finance, refinery, and petrochemical industries | • | Extensive experience leading international trade negotiations and detailed knowledge and insight into challenges and opportunities related to government relations | • | Broad experience managing technology platforms for investment managers and retail clients | • | Significant financial experience through senior leadership roles in banking, brokerage, and financial services companies | • | Substantial experience as a Fortune 500 company director |

|

| | | | | | | | | | | | | | JUDD GREGG Former Governor and U.S. Senator of JUDD GREGG, Former Governor and U.S. Senator of New Hampshire

| | Years of Service: 7

Age: 71About

Board Committees:

•Corporate Governance &Senator Gregg has spent over three decades in public office, most recently serving as the United States Senator from the State of New Hampshire from January 1993 until January 2011. During his tenure in the Senate, Senator Gregg served on a number of key Senate Committees including Budget; Appropriations; Government Affairs; Banking, Housing and Urban Affairs; Commerce, Science and Transportation; Foreign Relations; and Health, Education, Labor and Pensions. He has served as the Chairman and Ranking Member of the Health, Education, Labor and Pensions Committee and the Chairman and Ranking Member of the Senate Budget Committee as well as chairman of various sub-committees. Senator Gregg served as a chief negotiator of the Emergency Economic Stabilization Act of 2008 and was the lead sponsor of the Deficit Reduction Act of 2005, and, along with the late Senator Ted Kennedy, co-authored the No Child Left Behind Act of 2001. In March 2010, Senator Gregg was appointed to President Obama’s bipartisan National Commission on Fiscal Responsibility

•Audit